Carbon Pricing in Brief

Climate change, driven by greenhouse gas emissions, is not slowing down. Global emissions continue to grow, in spite of numerous goals, promises, treaties and efforts. International agreements and individual behavior are critical, but not enough. We need a broader set of economic incentives – policies that align “human nature” with “mother nature”.

That’s where the power of economic incentives comes into play. We need policies that reflect the true cost of putting carbon into the atmosphere, and at the same time put a value on both reductions in carbon emissions and carbon capture and sequestration.

Putting a price on carbon can do that. Carbon pricing is growing both in use and support. A price on carbon emissions can release the powerful forces of the marketplace. Let the market work to decrease demand, drive down emissions and grow innovations, while at the same time growing jobs. That future is exciting – and profitable.

Carbon Pricing in Brief

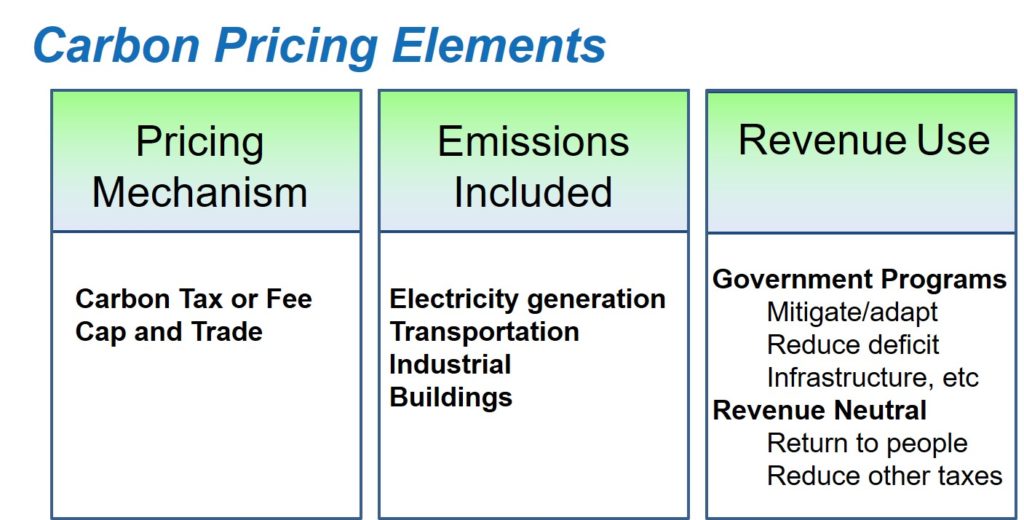

There are three primary elements to any pricing scheme:  1) the pricing mechanism (cap and trade or carbon tax), 2) the emission sources included, and 3) how the revenue is used.

1) the pricing mechanism (cap and trade or carbon tax), 2) the emission sources included, and 3) how the revenue is used.

Pricing Mechanisms

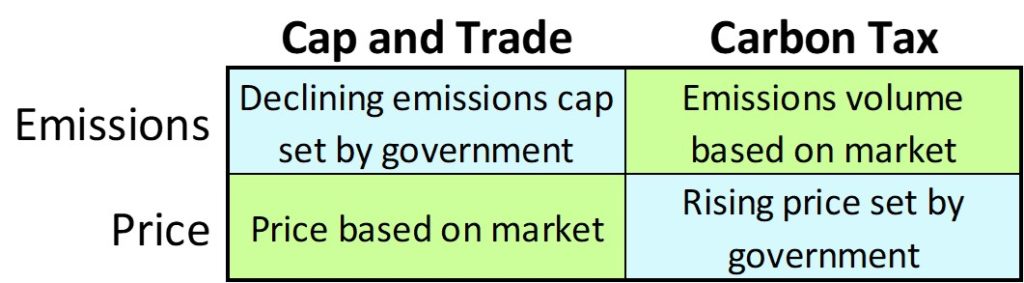

Putting a price on carbon emissions can be done by principally two methods: Cap and  Trade and Carbon Tax. The essential difference between the two methods is where the government control is set and where the market control is set, as shown in the table. Hybrid models using elements of either are also possible.

Trade and Carbon Tax. The essential difference between the two methods is where the government control is set and where the market control is set, as shown in the table. Hybrid models using elements of either are also possible.

Cap and Trade

In cap and trade, a cap of carbon emissions is set by the government on various parts of the economy, such as power plants, manufacturing, and transportation. The cap is based on previous emissions and declines over time. Each emitter must have permits sufficient for their emissions. These permits — or “allowances” — are sold at auction by the government. If a company does not have sufficient permits for their emissions, they can buy permits on the open market from those who have more permits than they need. Thus the emissions levels are set by the government, and the eventual price is set by the market. Emissions are monitored and tracked by the Environmental Protection Agency in the U.S. and local equivalents, as well as by industries themselves.

More on cap and trade. See also, Environmental Defense Fund site. To compare systems of cap and trade see information from the World Bank.

Carbon Tax

Like it sounds, a carbon tax is a price on carbon emissions set by the government. It can start low and ramp up with time. With a carbon tax, emissions would be a cost to a business, and those business would attempt to minimize those costs, thereby causing a decline in emissions coincident with that cost reduction. Like allowances, or free permits, in cap and trade, tax breaks could serve the same purpose. Similarly, while offsets are typically associated with cap and trade, again tax breaks for capturing and sequestering carbon would have the same effect. The latest U.S. Congressional proposals for carbon tax all have an element of offsets.

Emissions Included

Carbon pricing can apply to a variety of emission sources. Some pricing systems, like the Regional Greenhouse Gas Initiative (RGGI), in effect in nine northeastern U.S. states, is only on power generation which covers about 20% of total emissions; by contrast, the California cap and trade, extended in 2015 to include transportation, now covers about 85% of emissions. Most global pricing systems include power generation and industrial, but only a few include transportation (California, Quebec, New Zealand, Kazakhstan, and Shanghai).

Most pricing systems cover in the range of 30-40% of emissions where they apply. To be most effective in modifying behaviors and business, the proportion of emissions covered needs to be much closer to 100%.

Revenue Use

Determining options for the revenue generated by the two principal pricing mechanisms is where the rubber meets the road. The options range from revenue used for government programs, such as we see in California, to “revenue neutral” such as we see in British Columbia where revenues are returned to the households and businesses through cuts in other taxes, or as a dividend in equal shares to all citizens, as proposed by the Citizens’ Climate Lobby.

Other ways to distribute revenue include: reduce the deficit, invest in specific programs like infrastructure, reduce payroll or labor income taxes, reduce capital taxes, corporate income taxes or capital gains tax, or give revenue to states or other sub-federal level entities.

One critical investment that must be made is in research – research on alternative fuels, distributed capture (forestry, agriculture and geologic processes), energy efficiency, alternative energy sources, and land use planning, batteries, and so on. But also it is imperative that we invest in basic research on how the climate system works, glaciology, oceanography, biochemistry, and much more. Releasing the human brain and the human spirit will bring amazing results.