A Marathon, Not a Sprint

Posted: August 31, 2018

Republican Congressman Carlos Curbelo has introduced a carbon tax bill. Although no one thinks the bill will pass this year, Mr. Curbelo is hoping to spark constructive dialog across the aisle for a bi-partisan carbon pricing agreement. That will take time. But allowing all ideas and concerns to be discussed is the only way forward. And the time may be right.

Republican Congressman Carlos Curbelo has introduced a carbon tax bill. Although no one thinks the bill will pass this year, Mr. Curbelo is hoping to spark constructive dialog across the aisle for a bi-partisan carbon pricing agreement. That will take time. But allowing all ideas and concerns to be discussed is the only way forward. And the time may be right.

Since 1990 there have been 45 Congressional proposals to price carbon. Why is this one different? Three reasons:

- This legislation is proposed by Republicans. Since 2009, all proposals were by Democrats with pretty much no Republican engagement (at least not in public).

- Curbelo’s proposal doesn’t just price carbon and cut emissions. It also includes infrastructure investment, elements of deregulation, and tax reform. More on that later.

- Curbelo is co-chair of the Climate Solutions Caucus with 86 House members – half Republican and half Democrat – providing a positive venue to begin discussions.

What the Bill* Does

The bill puts a price of $24/metric ton on CO2e that would be released by combustion of fossil fuel produced in or imported to the U.S. The tax is taken at point of sale or at the border. The price increases annually by 2% plus CPI. There is a refund if the tax causes double payments due to state measures (e.g. cap and trade in California).

Emissions Are Reduced: Modeling shows a decrease of emissions of 27-32 percent by 2025, 30-40 percent by 2030 (relative to 2005). This exceeds the U.S. goal in the Paris Accord. There are provisions to track emissions and modify requirements if not on target.

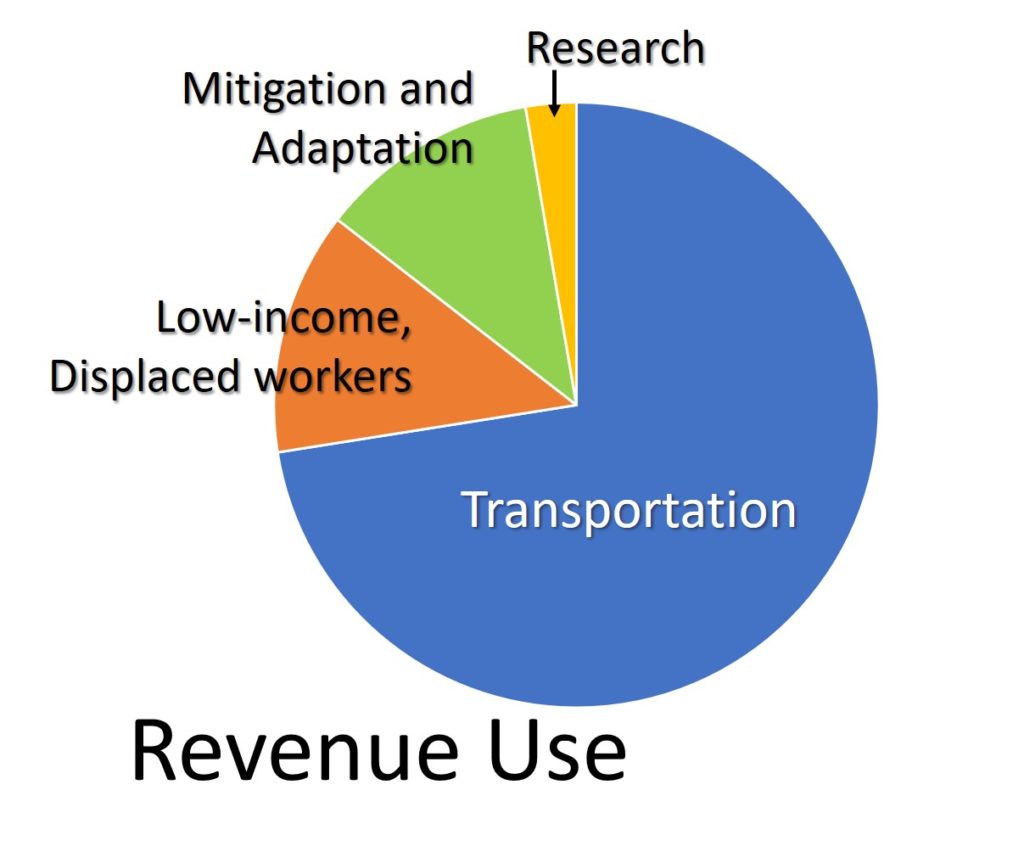

Protection for Low-Income: Ten percent of revenue will go to low-income households who are most negatively affected both by the tax and by climate change. Three percent will go to help displaced energy workers.

households who are most negatively affected both by the tax and by climate change. Three percent will go to help displaced energy workers.

Out with the Bad, in with the Better: The bill repeals the federal excise tax on liquid transportation fuels to avoid double taxation. The carbon tax – which is on more than transportation fuels – will increase government revenue by $60-70 billion over the gas tax, and 70% of that will go to fixing our transportation infrastructure. A need even Ms. Clinton and Mr. Trump agreed on.

Positive Investments: Nearly fifteen percent of revenue will be used for mitigation and adaptation strategies such as carbon sequestration, reforestation, coastal flooding, and research.

Deregulation: A 12-year moratorium is placed on regulations of greenhouse gases that will be taxed. The total authority to regulate is not affected; simply placed on hold.

Effects on Economic Growth “are close to zero, indicating that the drag on economic growth caused by the increase in prices is roughly offset by the positive effects of revenue use”. Columbia University report, 2018. Modeling shows a small negative impact on GDP and employment.

BUT: The positive economic effects of reduced air pollution and reduced climate change – which are difficult to estimate but may be huge – are not included in the analysis. Or to look at the negative, if we don’t address climate change, negative effects will cost trillions.

Pricing carbon will encourage innovation and investment in renewables and zero-carbon technologies; it will reduce air pollution; and most importantly it will keep the worst effects of climate change at bay.

These are good outcomes. Let’s open the discussion.

*Based on July 18, 2018 bill draft.