Oil Price and Ricochets

Posted: February 10, 2015

You’ve noticed that the price of oil is low. It bounced back a little from it’s January 29 low of $44/barrel for West Texas Intermediate, but is still well below its flirtation with $100 oil. One of the reasons for the increased supply of crude, and hence the price drop, is increased supply from U.S. production from tight reservoirs, dominantly shale, produced using hydraulic fracturing. Another reason is that the Saudis, particularly, are producing at a high rate, with the assumed intention of putting the U.S. shale production out of business. Whether that is indeed their strategy is not known. But the countries that are really hit are Russia, Iran and Venezuela; the first two are known rivals of Saudi Arabia.

Although all three rely on oil revenues for their economic and budget stability, Iran and Russia have some back-up reserves. Not so with Venezuela which gets nearly half its government revenue from oil exports. Everyday Venezuelans are suffering with shortages while President Maduro is finger-pointing at scheming capitalists, blaming them for the problems.

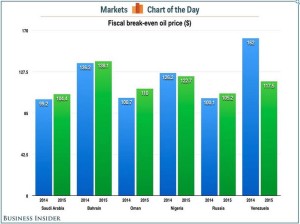

How long these countries can hold out at low prices is a good question, since they are all being impacted. The fiscal break-even oil price for key producing countries is seen in the figure on the right, published by Business Insider. (Click on figure to enlarge.)

Oil prices are hovering around US$50-60 per barrel which is well below any of the oil producing countries’ break-even which are all near or above $100 oil.

By contrast, Wood Mackenzie, a research consultancy, estimates that the “break-even price” of U.S. shale projects is clustered around $65-70, as quoted in The Economist. But we can expect to see oil and gas companies “hunker down in the weeds” for awhile. Interestingly, most major oil companies are not the big shale producers. Rather, smaller companies have jumped in, ramping up production since about 2008 when the price of oil was very high, reaching a maximum of $145 for WTI in 2008. Although that was the spike, prices have been in the $60-$100 range throughout shale production.

Those companies that have taken on debt will be vulnerable at lower prices, but it’s likely there will be no shortage of buyers for them. The sunk costs make the marginal costs low enough to still make money. But new drilling and service companies will continue to suffer for awhile.

As astutely reported in an article by National Geographic, perhaps a bigger factor is that U.S. shale oil will run out long before supplies in the Middle East, because there simply is not as much oil in the U.S. deposits.

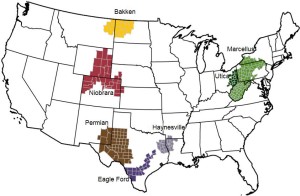

The Energy Department’s estimate of shale oil “proved reserves” —those that can be recovered economically today—is about ten billion barrels, principally from the areas shown on the map at right.

Map source U.S. EIA. Click on figure to enlarge.

In contrast, the proved reserves from just three Middle East nations—Saudi Arabia, Kuwait, and the United Arab Emirates—total more than 460 billion barrels.

Which one will run out first?

No one has left a comment yet.