Washington State

Washington state has had several recent attempts to get a carbon tax. Attempts included several carbon tax bills in both 2017 and 2018, and two separate initiatives for different versions of a carbon tax in 2016 and 2018. None has passed.

Washington state’s Clean Air Rule, September 15, 2016, instituted what is essentially cap and trade on large stationary emission sources. The Emission Reduction Units (ERUs) are approximately equivalent to allowances used in other cap and trade systems. The declining cap is set to decline by 1.7% per year from the baseline calculated by the Washington state Department of Ecology for each entity. ERUs can be traded within Washington and with other states, provinces, or nations with similar systems. The Clean Air Act was subject to litigation, but in 2020, the Washington State Supreme Court ruled that the portions of the rule that applied to stationary sources were upheld

Both cap and trade and carbon tax legislation have been proposed in Washington, but none has passed. The most recent is a cap and trade proposal SB 5981 (2019).

History of Washington Legislation and Initiatives

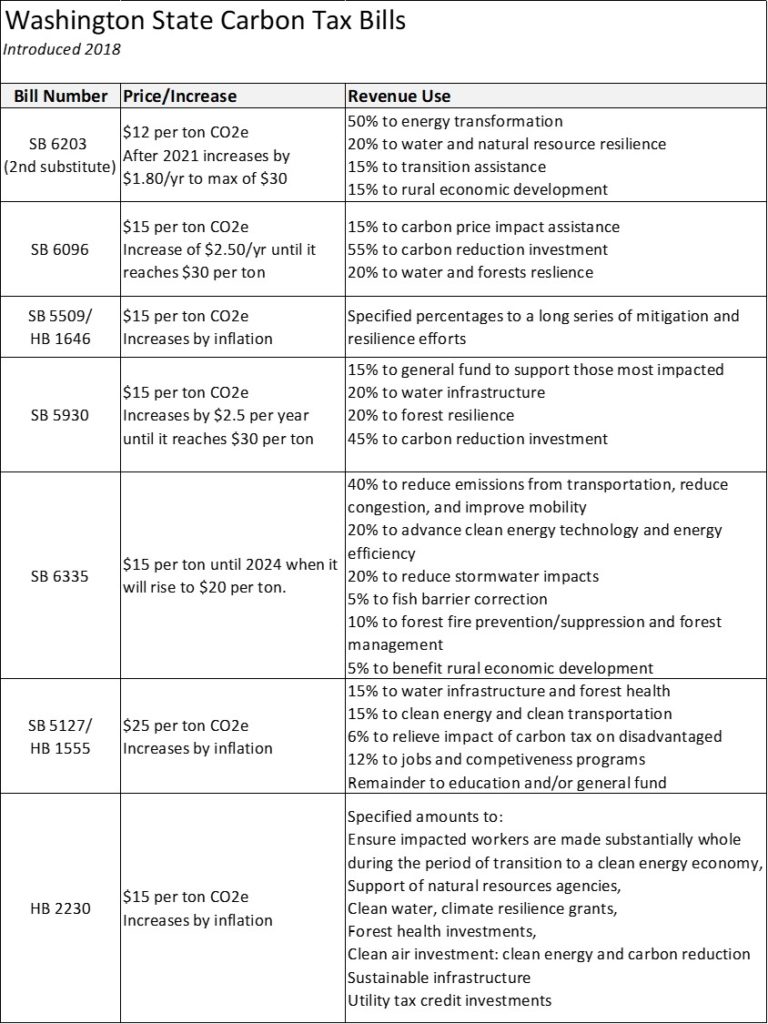

In January 2018 seven different carbon tax bills were introduced.

In January 2018 seven different carbon tax bills were introduced.

They differed by the amount of tax and the tax increase, and in details of how the revenue is to be spent. The differences are seen in the table below. All the bills allow for some exemptions and/or tax credits.

This plethora of bills will likely be combined into a compromise bill if they gain ground at all. SB 6203 seems to have the most opportunity. There have been two substitutions of the original bill.

Ballot Measure I-1631 has qualified for the ballot in 2018. It proposes a tax of $15/ton, increasing by $2/yr plus inflation to 2035. There are exemptions for energy intensive industries and others. All of the tax on utilities is returned to utilities. Balance is split with 50% in carbon reductions, 20% water/forest programs, 15% low income programs and 15% rural economic development. See a comparison chart of SB 6203 and I-1631 here.

In the 2017 session five carbon tax bills were proposed:

- SB 5127/HB 1555 (Senators Braun, Ranker, and Hunt; Reps. Lytten and Doglio) creates a carbon tax on fossil fuels beginning at $25/ton carbon dioxide with a 3.5% increase + inflation each year, with revenues to be used for industrial energy efficiency, clean transportation, energy efficiency of existing buildings, and emerging technologies.

- HB 1646/SB 5509 (Reps. Fitzgibbon, Appleton, Fey, Goodman, McBride, Cody, Macri, Doglio, Pollet, and Jinkins; Senators Carlyle, Ranker, Frockt, Hunt, and Saldaña) imposes a carbon tax on fossil fuel emissions. It creates a carbon program oversight board to advise the governor on how best to reduce greenhouse gas emissions in addition to creating an economic and environmental justice oversight panel. The bill proposes a $15/ton carbon dioxide fee with a 7% increase + inflation each year. Revenue would be put towards storm water infrastructure, transportation, clean tech, utilities, and social justice. The House bill was proposed by the Alliance for Jobs and Clean Energy.

- SB 5385 (Senators Hobbs and Hunt) imposes a fossil fuel carbon pollution tax of $15/ton carbon dioxide. This bill requires at least 50% of funds to be transferred to the multimodal transportation account to assist certain school district programs.

A Lesson to Learn from…Washington had a revenue neutral carbon tax on the 2016 ballot. Initiative 732 would have taxed carbon, and returned revenue as reduced tax to all and rebates to working families.

Initiative 732 was modeled after the carbon tax in British Columbia, but also included a rebate to working families. It would have placed an initial $25 tax on a metric ton of carbon dioxide, and then use that money to fund both tax cuts and tax rebates throughout the state.

The campaign for I -732 was not united. Groups like the Washington Environmental Council and the Sierra Club opposed the measure because it didn’t go far enough, notably not investing in the huge infrastructure that will be needed to move to a decarbonized economy.With the divided campaign the measure failed with a 59% No vote.

A second initiative attempt to institute a carbon fee (I-1631) also failed in the 2018 mid-term elections. It was opposed principally by oil companies, with a whopping $31 million budget.

History of U.S. Federal Carbon Pricing Legislation

Last updated January 28, 2019