Carbon Tax vs. Cap and Trade

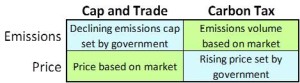

Much has been written debating which is “better” — carbon tax or cap and trade. The essential difference is simply whether government controls the price or the level of emissions as shown in the simple table. Both can work to reduce emissions.

Cap and trade will assure that we reach our emissions target, which is a key objective to limit climate change. A carbon tax will also reduce emissions, but must rely on the market to do so. As argued by Alice Lépissier and Owen Barder in a 2014 economic paper, “… we don’t necessarily know the right price to set on carbon. Setting it too high could have large economic costs and setting it too low would lead to potentially irreversible climate change. Given that our key underlying objective is to limit the volume of carbon emissions, then we should set the quantity and let the market take care of setting the price. That is the simplified case for cap-and-trade.”

Some mis-conceptions

Both cap and trade and carbon tax are working. Proponents of carbon tax often claim that cap and trade is prone to “market disruptions” and that “it doesn’t work”. In truth, after a couple of rocky starts, the EU ETS, RGGI, California and other markets are working smoothly. Further, every carbon market we have so far has met its emissions targets. While carbon taxes are working where employed, the tax will need to increase to continue to drive down emissions. None of the systems of carbon tax have been in place broadly or long enough to test whether taxes can be successfully increased to the levels needed.

Allocations and offsets are typically associated with cap and trade, but a system of carbon tax can have the same effect by allowing tax breaks.

Either system can return revenue to the households and businesses via other tax cuts or use the revenue to support government programs. Either system can include all or only some emissions. Based on the evolution so far, both systems will be in place for some period of time. Beyond which system is the best fit, we need to also consider what emissions are included and how the revenue is controlled and used.

Both Cap and Trade and Carbon Tax are Growing

Data and maps from the World Bank.