Carbon Pricing

“Carbon pricing” can have different meanings. Explicit carbon pricing puts a price directly on carbon emissions, like carbon tax and cap and trade. Implicit pricing includes policies or instruments that effectively price carbon, such as gasoline taxes. Negative carbon pricing includes subsidies or support for fossil fuel production or use which lead to emissions of carbon dioxide.

Explicit Carbon Pricing

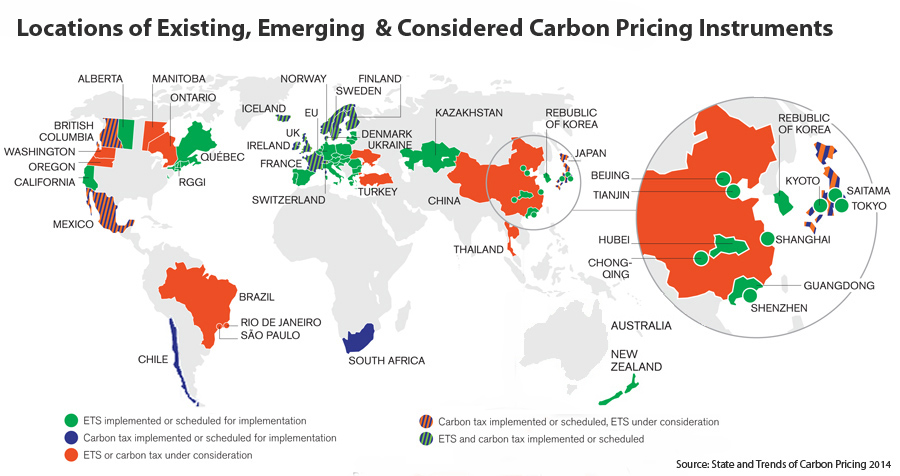

As of 2014 there are 29 explicit carbon pricing schemes at regional, state and country levels, with 12 more at some stage of development as shown in the map from the World Bank Report of May 2014.

And in a very significant new development, the two leading emitters of CO2, the U.S. and China, in November of 2014, announced an agreement to set targets for CO2 emissions out to the year 2030. Although no “teeth” were included in the agreement, it is very possible that these two very competitive countries will seek to outdo one another in meeting these goals, effectively reinforcing the agreement.

Also, many companies have disclosed using a price on carbon in their long range planning; prices reported to CDP range from US$10-20 for the Walt Disney Company, US$14 for Google to US$60-80 for ExxonMobil.

The World Bank and many others support carbon pricing through either cap and trade or carbon tax. Regardless of the type, there are some key traits of a desirable pricing system as described by Ian Perry, Principal Environmental Fiscal Policy Expert, Fiscal Affairs Department, International Monetary Fund (IMF),

Implicit Carbon Pricing

Taxes and other instruments have the effect of putting a price on carbon, some in an obvious way, and others not so obvious. An excellent report by the OECD and references therein summarize implicit pricing, dividing it into three main areas:

Transportation includes taxes on liquid transportation fuels, mostly gasoline and diesel. In the U.S., average taxes, including federal and state taxes, are US$0.48 per gallon for gasoline and US$0.54 per gallon for diesel. Equivalent taxes in other OECD countries can be significantly higher, up to and over US$200 per gallon of fuel.

Other less obvious implicit pricing on transportation – either positive or negative – include tax exemptions on biofuels or other renewables, fuel mandates, and support for electric vehicles.

Electricity is a secondary energy sourced by burning of fossil fuels, solar, wind, or other kinetic sources. Electricity can be taxed by taxing the fuels used to generate electricity, and/or by taxing the consumption of electricity. Implicit pricing includes fuel switching subsidies and other schemes to enhance use of renewable sources, and Feed-in-Tariffs on renewable generation. With a Feed-in-Tariff, residential or other generators of renewable electricity are paid by utilities or the government for any surplus energy provided to the grid.

Heating and Process Use for industrial or energy transformation purposes are taxed at a different rate than the same energy products used for residential or commercial use. Depending on the country, these taxes can be either lower or higher depending on the goal of the tax.

Negative Carbon Pricing

Depending on the country, there is a wide range of budgetary transfers and tax expenditures in place that encourage the production and use of fossil fuels. These mechanisms are in direct conflict and counter most of the explicit and implicit pricing mechanisms, skewing the market, sometimes dramatically. The OECD has identified over 550 individual support mechanisms that directly or indirectly encourage the production or consumption of fossil fuels across OECD countries.