Revenue Use – Why it Counts

Posted: May 25, 2017

“We are not taking climate seriously until we price carbon”, said Dr. Adele Morris. She then showed how we can price carbon while growing the economy and still protect lower-income or hard-hit communities from negative consequences.

“We are not taking climate seriously until we price carbon”, said Dr. Adele Morris. She then showed how we can price carbon while growing the economy and still protect lower-income or hard-hit communities from negative consequences.

Dr. Adele Morris an economist at the Brookings Institution spoke in a webinar hosted by PriceonCarbon.org and the League of Women Voters on May 23, 2017, outlining a path to a cost-effective way to significantly lower greenhouse gas emissions – putting a price on carbon.

Either cap and trade or a carbon tax can be used to put a price on carbon. They differ primarily in where the uncertainty lies. Cap and trade has uncertainty in price, while carbon tax has uncertainty in emissions reductions. Either can be much more cost effective than regulation under the Clean Air Act.

Dr. Morris reviewed the eleven key design elements for a carbon tax, one of which is consideration of what to do with the revenue. With either a carbon tax or cap and trade, revenue is generated, and it can be considerable. Estimates for net revenues in a 10-year budget window from hundreds of billions to $1-2 TRILLION. Considerable indeed.

How revenue is used is critical

Consider two scenarios. If revenue is used to reduce capital tax (corporate income tax, capital gains, etc.) Brookings modeling of a modest carbon tax shows an increase in GDP by 1% to 1.5% within the first few years, extending out to 25 years. If revenue is given as a lump sum rebate, deficit reduction, and labor tax swap, GDP declines, but very slightly, over the 25-year period.

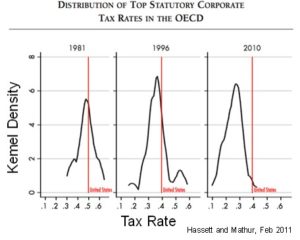

U.S. corporate income tax has grown steadily relative to other  OECD countries over the past 30 years and now is significantly higher than OECD competitors. (Figure to right). Reducing our capital taxes would make the U.S. more competitive and attractive for investment.

OECD countries over the past 30 years and now is significantly higher than OECD competitors. (Figure to right). Reducing our capital taxes would make the U.S. more competitive and attractive for investment.

But there is more to the question than macroeconomic benefits. Lower income households have the highest proportional burden of bearing a tax on carbon. And hard hit communities, like coal communities, will lose jobs and their current local economic engine.

We cannot ignore these negative consequences, but simple trade-offs can help low income and hard-hit households and communities in other ways. For example, some, but not necessarily all, of the revenue can be used for rebates, as well as other targeted tax credits and benefits.

Also, we must make sure that U.S. firms are not harmed relative to outside competitors. To that end, we should begin any price at a modest level and increase it gradually, giving industry a chance to reduce emissions. We could replace or suspend regulatory authority, reduce corporate income tax rates, establish border carbon adjustments, and use vigorous diplomacy to support our U.S. businesses.

Opening for negotiations

It is apparent that there is ripe opportunity to make deals on how revenue might be used. Bi-partisanship is growing in the Congress making negotiation increasingly possible. Evaluating trade-offs and reaching compromises based on revenue options gives good room for negotiations.

What about state-level price on carbon?

Some form of cap and trade is in force in California, Washington, and with the Regional Greenhouse Gas Initiative in nine northeastern states. In addition, six northeastern states and four western states have carbon pricing proposals in their 2017 legislatures. An effort to combine into a region is seen where Rhode Island’s proposal for a carbon tax will only go into effect if Massachusetts and Connecticut pass similar measures.

Although a state level carbon price is not as efficient as a federal program, having a demonstration of how a carbon tax can work at state-level would be influential at the federal level.

Reading the tea leaves

When asked about the possibility of federal legislation, Dr. Morris said she doesn’t see much appetite for stand-alone climate legislation like fee and dividend. Rather, she suggests that a carbon excise tax might be embedded in a broader tax or infrastructure bill, such as a “pay for” vehicle in a broader tax bill. “Maybe I’m a dreamer,” she said, “but I’m not the only one.”

Publications Recommended by Adele Morris

11 Essential Questions for Designing a Policy to Price Carbon (Adele Morris, Jul 2016

How to Use Carbon Tax Revenues (D.B. Marron and Adele Morris, Feb 2016)

Implementing a U.S. Carbon Tax: Challenges and Debates (book, Ian Parry, Adele Morris, Roberton C. Williams III (Editors))

A Carbon Tax in Broader U.S. Fiscal Reform: Design and Distributional Issues (Adele Morris and Aparna Mathur, May 2014)

State Level Carbon Taxes: Options and Opportunities for Policymakers (Adele Morris, Yoram Bauman, David Bookbinder, July 2016)

- Carbon Taxes and U.S. Fiscal Reform, Warwick J. McKibbin, Adele C. Morris, Peter J. Wilcoxen, and Yiyong Cai

- Carbon Taxes and Fiscal Reform In The United States, Dale W. Jorgenson, Richard J. Goettle, Mun S. Ho, and Peter J. Wilcoxen

- Environmental Policy for Fiscal Reform: Can a Carbon Tax Play a Role? Sugandha D. Tuladhar, W. David Montgomery, and Noah Kaufman

- Carbon Taxes, Deficits, and Energy Policy Interactions, Sebastian Rausch and John Reilly

- The Initial Incidence of a Carbon Tax Across Income Groups, Roberton C. Williams III, Hal Gordon, Dallas Burtraw, Jared C. Carbone, and Richard D. Morgenstern